活动预告|国家自然科学基金重大项目系列讲座

暨“学术大讲堂”2025春季第4期

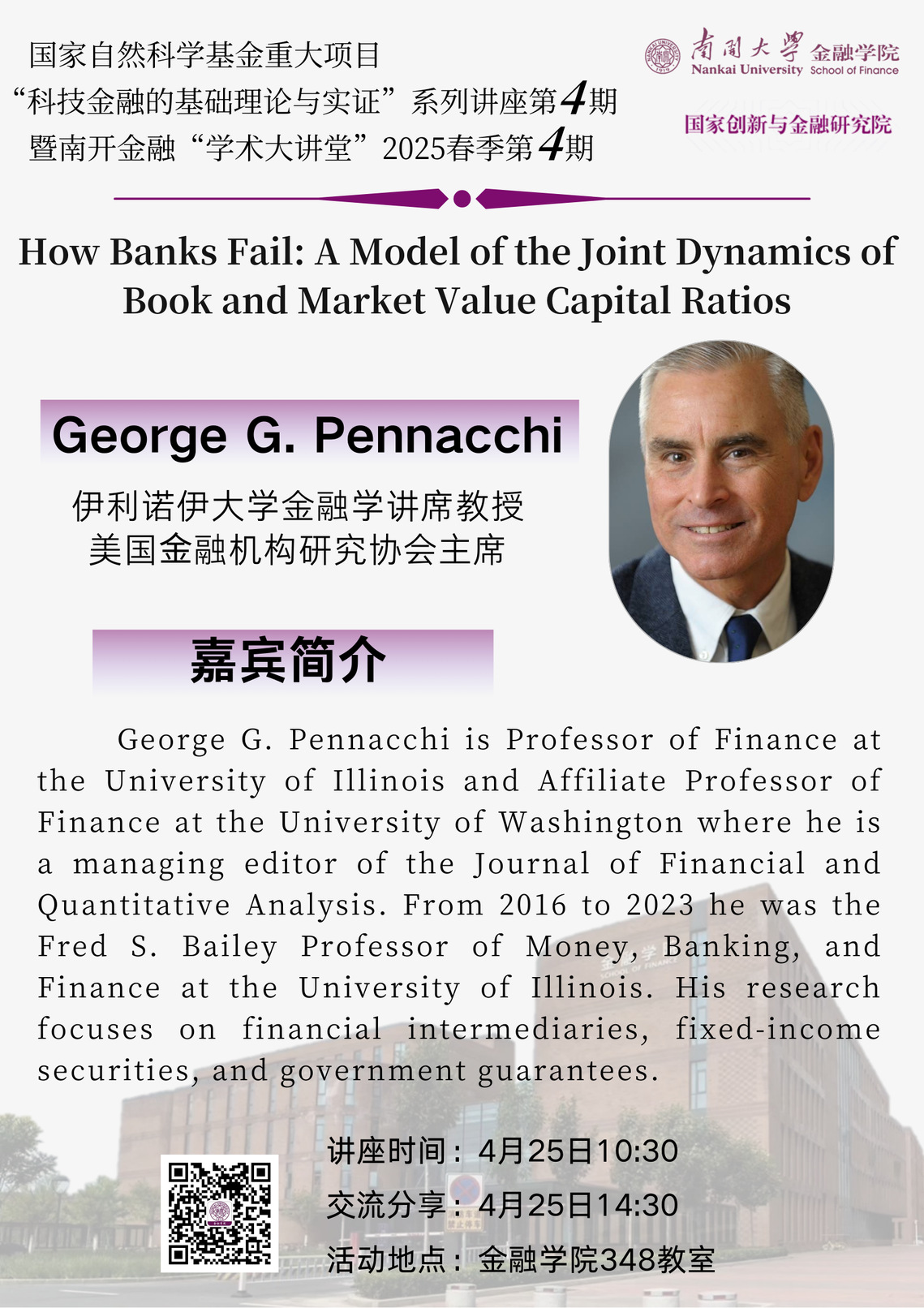

讲座题目:How Banks Fail:A Model of the Joint Dynamics of Book and Market Value Capital Ratios

主讲嘉宾:George G. Pennacchi

伊利诺伊大学金融学讲席教授

美国⾦融机构研究协会主席

讲座时间:2025年4月25日(周五)10:30

交流分享时间:2025年4月25日(周五)14:30

活动地点:金融学院348教室

嘉宾简介

George G. Pennacchi is Professor of Finance at the University of Illinois and Affiliate Professor of Finance at the University of Washington where he is a managing editor of the Journal of Financial and Quantitative Analysis. From 2016 to 2023 he was the Fred S. Bailey Professor of Money, Banking, and Finance at the University of Illinois. His research focuses on financial intermediaries, fixed-income securities, and government guarantees.

He has served as President of the Financial Intermediation Research Society, the managing editor of the Journal of Financial Intermediation, and an associate editor of several journals including the Journal of Finance and the Review of Financial Studies. His consulting experience includes work for the Federal Reserve System, the FDIC, the U.S. Office of Management and Budget, the Bank of Finland, and the Financial Stability Board. He was a member of the finance faculty at the Wharton School of the University of Pennsylvania.

摘要Abstract

This paper develops a model of the joint dynamics of a bank’s book value and market value of capital (net worth). The bank is assumed to target its book value regulatory capital ratio by adjusting its shareholder payouts and its debt issuance (leverage). The bank’s book values of assets are partially marked to market, and unrealized market capital gains/losses are only gradually reflected in book values. The model is calibrated to data on North American and European banks and is used to explain stylized facts of bank behavior, both during normal times and at the times of failure. The model is also employed to analyze the effectiveness of different regulatory policies on maintaining bank stability and mitigating losses due to failure.