活动预告 | 正午阳光——青年学者论坛(2024秋季)第六期

“正午阳光——青年学者论坛”是金融学院定期举办的以院内师生参与为主的学术交流活动,为全院专家学者之间、师生之间、南开金融与国际国内学术界之间提供了难得的交流机会。本学期“正午阳光”论坛初心不改,扬帆远航再出发,致力于营造学院学校科研氛围,推动师生学术科研水平不断提升!

2024年秋季学期 “正午阳光——青年学者论坛”第六期活动安排如下:

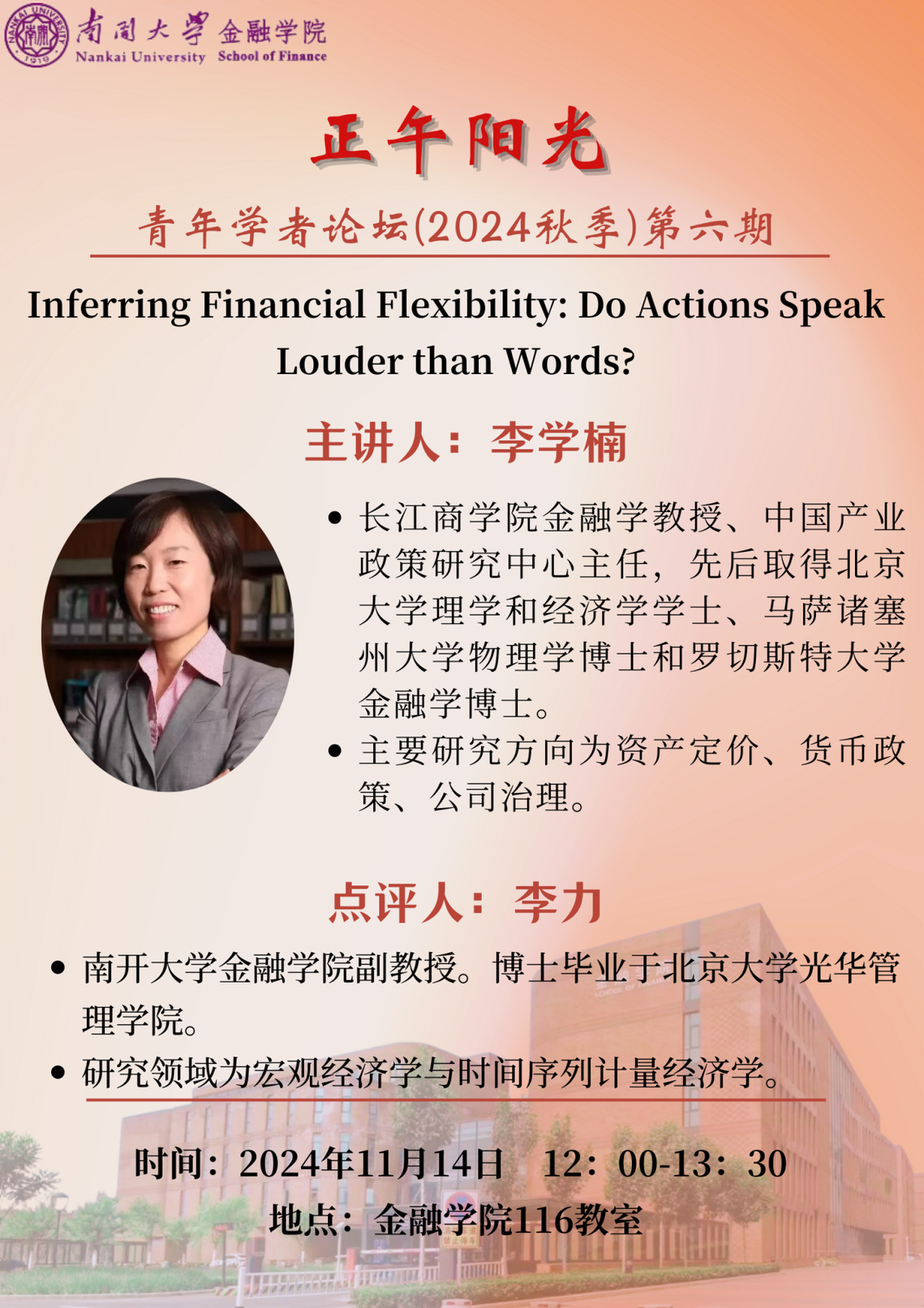

讲座题目:Inferring Financial Flexibility:Do Actions Speak Louder than Words?

主讲人:李学楠

李学楠,长江商学院金融学教授、中国产业政策研究中心主任,先后取得北京大学理学和经济学学士、马萨诸塞州大学物理学博士和罗切斯特大学金融学博士。李教授在2007-2012期间执教于美国密歇根大学Ross商学院,2012年加入长江商学院,教授资产证券化和行为金融学等课程,主要从事资产定价、货币政策、公司治理方向的学术研究。她的论文在顶级杂志Review of Financial Studies, Journal of Financial Economics, Journal of Monetary Economics和Management Sciences上发表。李教授目前担任Journal of Empirical Finance, International Review of Finance和《经济管理学刊》等学术期刊的副主编,曾获得2023年CICF最佳论文奖、长江商学院杰出研究奖等荣誉。

点评人:李力

李力,南开大学金融学院副教授。博士毕业于北京大学光华管理学院。研究领域为宏观经济学与时间序列计量经济学。

讲座时间:2024年11月14日(周四)12:00-13:30

讲座地点:金融学院116教室

内容摘要

Firms invest intermittently, and a significant part of capital formation occurs during “investment spikes”. Industry-level “spike waves”, during which growth opportunities in an entire industry surge and a large fraction of firms in the industry generate investment spikes, also occur quite regularly. We define financial flexibility as the capacity to accommodate large shortfalls between a firm's investment needs and cash flow, as is the case when it has an investment spike. We develop an index for financial flexibility (FF) based on which firm-specific variables differentiate firms that generate investment spikes and those that do not during industry spike waves. In out-of-sample tests, our FF Index predicts investment spikes, as well as investment growth, future sales growth, investment in downturns and recovery, and stock returns in crisis periods. We posit that firms’ actions can be more revealing than what can be inferred from their 10-Ks about their financial status. To this end, we ask ChatGPT to “read” the “Liquidity and Capital Resources” section of a large sample of firms’ 10-Ks and classify firms on their capacity to undertake large investment. Based on these classifications, we generate an alternative “word-based” FF Index. However, our “firm-action-based” Index also outperforms this index. The predictive ability of the FF Index remains even when we control for commonly used financial constraint indices. We validate our empirical approach using data simulated in a model adapted from Gao, Whited, and Zhang (2021).