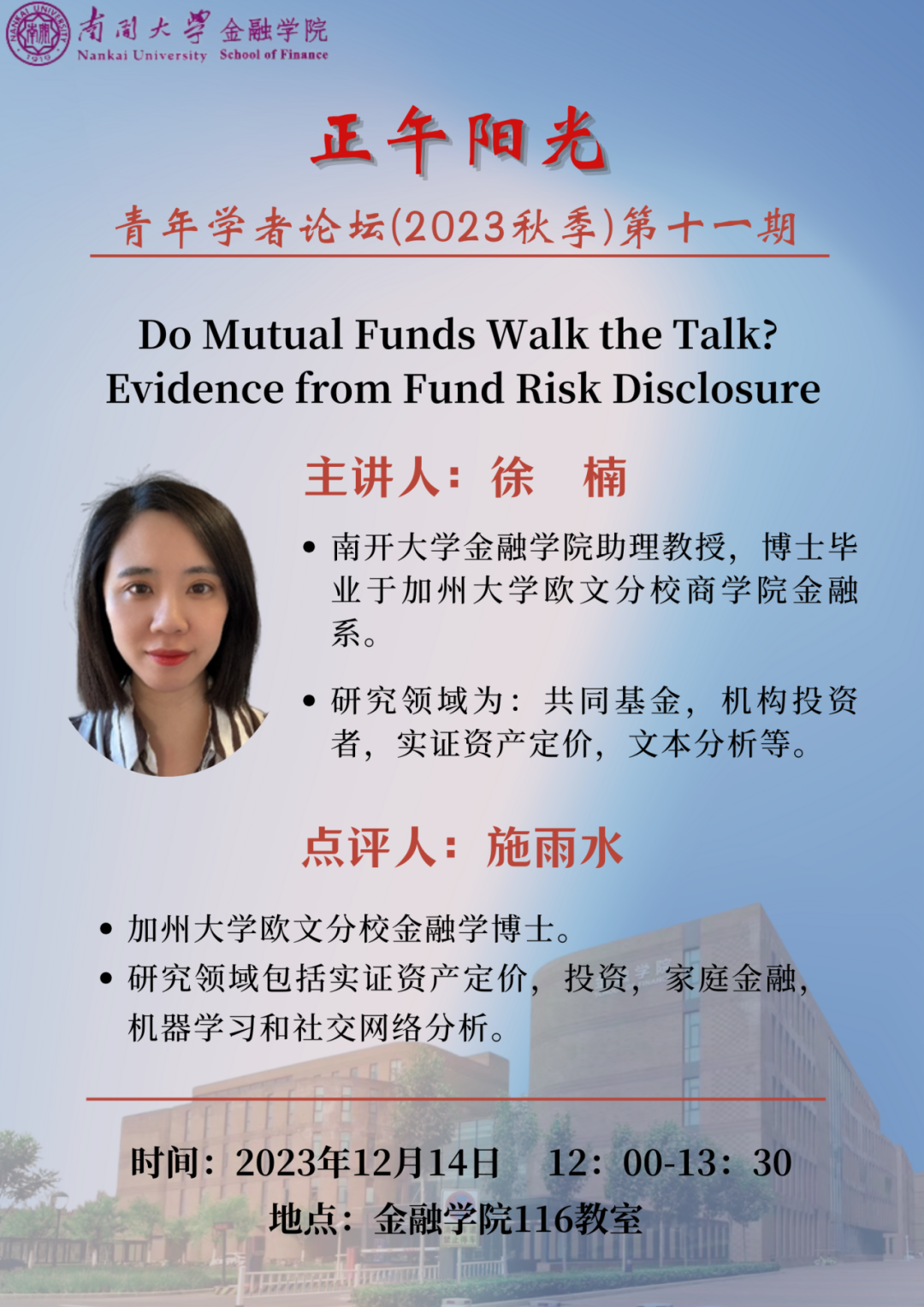

活动预告 | 正午阳光——青年学者论坛(2023秋季)第十一期

讲座题目:

Do Mutual Funds Walk the Talk? Evidence from Fund Risk Disclosure

主讲人:

徐楠,南开大学金融学院助理教授,博士毕业于加州大学欧文分校商学院金融系。研究领域为:共同基金,机构投资者,实证资产定价,文本分析等。

点评人:

Yushui Shi(施雨水),加州大学欧文分校金融学博士。研究领域包括实证资产定价,投资,家庭金融,机器学习和社交网络分析。论文在顶尖金融杂志发表,如JFE等。

内容摘要:

We examine the accuracy of mutual fund risk disclosure using the Risk Coverage Ratio (RCR), comparing the explanatory power of risks disclosed by a fund to that of all risks disclosed by all funds. Excluding market risk, the average fund RCR is 55%; RCR drops to 26% when we exclude information contained in fund names. RCR is positively related to flows from institutional investors. However, RCR correlates with lower future fund performance, suggesting costs associated with revealing private information. Notably, 56% of disclosed risks are insignificant, indicating over-disclosure. Funds improve the informativeness of risk disclosure after receiving SEC comment letters.