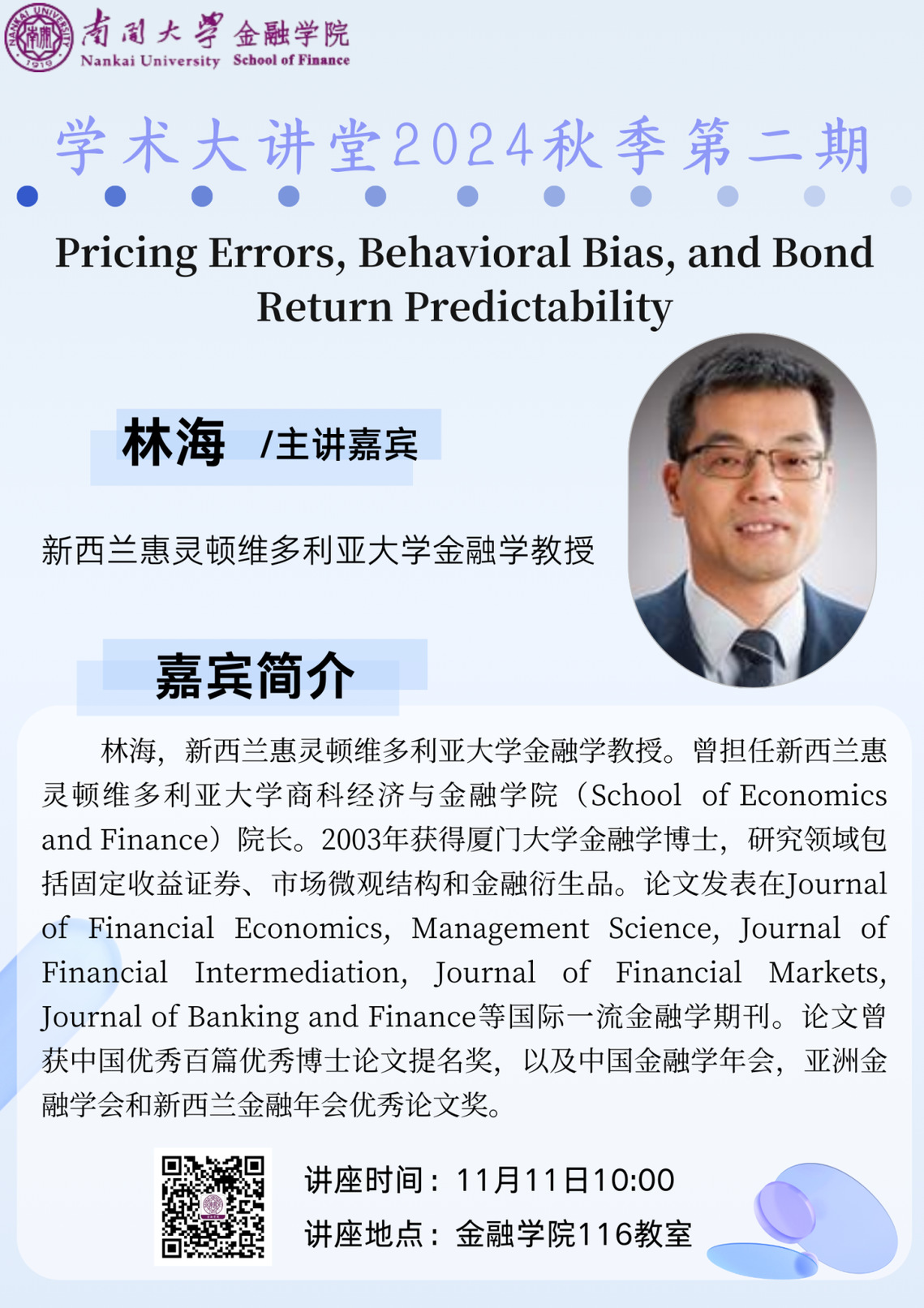

活动预告|学术大讲堂2024秋季第二期

讲座题目:Pricing Errors, Behavioral Bias, and Bond Return Predictability

主讲嘉宾:林海

新西兰惠灵顿维多利亚大学金融学教授

嘉宾简介

林海,新西兰惠灵顿维多利亚大学金融学教授。曾担任新西兰惠灵顿维多利亚大学商科经济与金融学院(School of Economics and Finance)院长。2003年获得厦门大学金融学博士,研究领域包括固定收益证券、市场微观结构和金融衍生品。论文发表在Journal of Financial Economics, Management Science, Journal of Financial Intermediation, Journal of Financial Markets, Journal of Banking and Finance等国际一流金融学期刊。论文曾获中国优秀百篇优秀博士论文提名奖,以及中国金融学年会,亚洲金融学会和新西兰金融年会优秀论文奖。

讲座时间:2024年11月11日(周一)10:00

讲座地点:金融学院116教室

内容摘要

The pricing error (PE) from the IPCA model of Kelly, Palhares, and Pruitt (2023) negatively predicts corporate bond returns in the cross-section. A long-short PE portfolio generates an average monthly return of 1.50%, which is economically significant and robust to using various factors and model specifications. Further analysis shows that investor sentiment is a plausible economic driver of PE predictability. However, it remains a puzzle why the PE predictability, which is the largest by far documented in the literature, is not arbitraged away. The predictability also suggests a need to improve the IPCA model to eliminate or reduce it theoretically.