活动预告 | 正午阳光——青年学者论坛(2023秋季)第12期

“正午阳光——青年学者论坛”是金融学院定期举办的以院内师生参与为主的学术交流活动,为全院专家学者之间、师生之间、南开金融与国际国内学术界之间提供了难得的交流机会。本学期“正午阳光”论坛初心不改,扬帆远航再出发,致力于营造学院学校科研氛围,推动师生学术科研水平不断提升!

2023年秋季学期 “正午阳光——青年学者论坛”第12期活动安排如下:

讲座题目:

Pricing the Priceless: The Cost of Biodiversity Preservation

主讲人:

高昊宇,中国人民大学财政金融学院教授,博士生导师,中国人民大学“杰出学者”青年学者,第5届中国科协“青年人才托举工程”入选人,博士毕业于中国科学院数学与系统科学研究院和香港城市大学。研究方向主要集中在银行与金融中介、金融风险管理、债务与信用市场和公司金融与中国资本市场等方面。代表性学术成果发表或接受发表在The Journal of Finance (JF)、The Review of Financial Studies (RFS)、Journal of Financial Economics (JFE)、Journal of Financial and Quantitative Analysis (JFQA)、《管理世界》《金融研究》《管理科学学报》《世界经济》《系统工程理论与实践》《经济学季刊》等国内外金融管理领域权威刊物。他结题一项国家自然科学基金青年项目(后评估特优),主持一项国家自然科学基金面上项目。

讲座时间:

2024年1月13日(周六), 14:00-17:00

讲座地点:

金融学院116教室

内容摘要:

Biodiversity loss is a crucial concern that demands a transition from current practices, which is anticipated to come at a substantial economic expense. However, how such a transition is priced in the financial markets remains unclear. In this paper, we aim to explore the impact of the Green Shield Action - a regulation change geared towards preserving biodiversity in nature reserves - on the local public financing costs in China. In a causal context, we show that this transition increases the municipal corporate bond yield by around 24 basis points. Employing precise geographic information and government procurement records, we emphasize the significance of transition costs as a pivotal mechanism. We find that the effects can be attributed to the transition pressure resulting from pre-existing human activities within nature reserves, and public spending related to biodiversity demonstrates notable growth following the reform. This paper provides a reference for addressing the financing gap in biodiversity conservation efforts and offers valuable insights for future regulatory interventions to counteract the declining trend of counteract the declining trend of biodiversity.

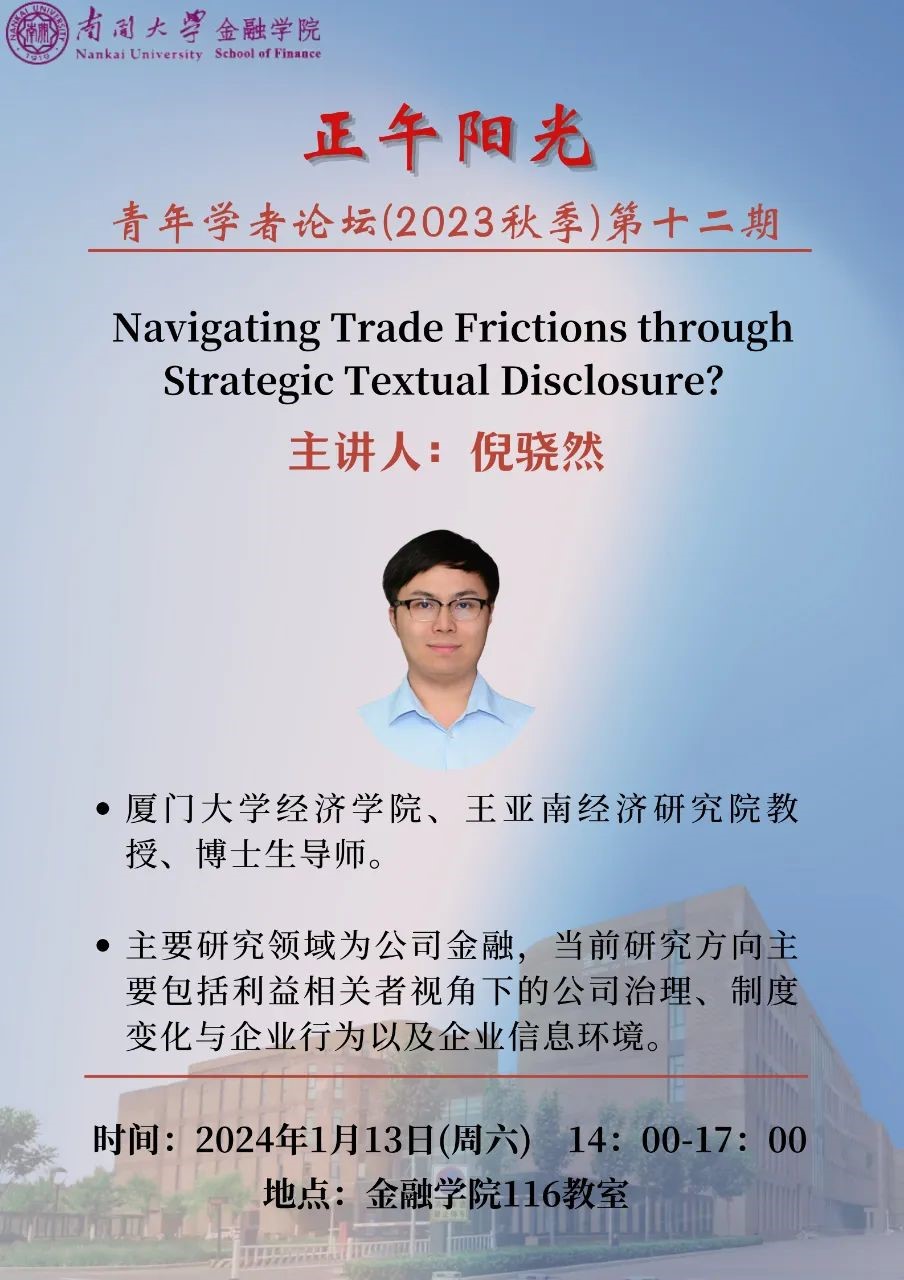

讲座题目:

Navigating Trade Frictions through Strategic Textual Disclosure? Evidence from MD&As

主讲人:

倪骁然,厦门大学经济学院、王亚南经济研究院教授、博士生导师、金融系副主任。在《经济研究》《管理世界》《经济学(季刊)》《金融研究》、Journal of Economic Behavior and Organization、Journal of Corporate Finance、Journal of Banking and Finance、Journal of Empirical Finance、Journal of Financial Markets等国内外重要学术期刊发表论文40余篇。主持国家自然科学基金面上项目、青年项目。入选中组部国家“万人计划”青年拔尖人才、财政部高层次财会人才素质提升工程、福建省百千万人才工程、厦门大学南强青年拔尖人才。获得福建省社会科学优秀成果二等奖、洪银兴经济学奖、亚洲金融学会年会最佳论文奖、厦门大学青年教师教学技能比赛一等奖等多项教学科研奖励。

讲座时间:

2024年1月13日(周六), 14:00-17:00

讲座地点:

金融学院116教室

内容摘要:

We exploit the outbreak of the U.S.‒China trade war in 2018 as a quasi-exogenous shock and examine how Chinese firms strategically respond by altering textual disclosure strategies. We find that in reaction to the shock, exposed firms significantly increase the fraction of positive tones in MD&As relative to other firms. This effect is more pronounced for firms in industries that are not supported by industrial policies, have a higher degree of global value chain embeddedness, lack government connections, or have lower cash holdings. Further analysis indicates that in the context of a trade war, more positive changes in abnormal tones help reduce financing costs, strengthen firm fundamentals, and improve firm value. Overall, our evidence indicates that strategic textual disclosure serves as an important way for firms to navigate trade frictions and mitigate trade policy trade policy uncertainty.

欢迎广大师生参与交流!